- Your cart is empty

- Continue Shopping

“Third Generation of Fast Fashion”

The E-commerce giant took a footstep in a competitive landscape by producing fast fashion quicker and cheaper than before. In the blink of an eye & the retail outlets of many fast fashion brands changing their trends and prices. The fast fashion paradigm shift with each generation starts with the first generation of Zara & H&M pioneered by setting high-end fashion to the high street. the trends for second-generation ASOS and BOHO which took fast fashion online. The third generation upgraded with Shein and Temu which is working on data-driven product design and testing. The global Fast Fashion Market was valued at USD 93.66 billion in 2022 and is projected to reach USD 167.50 billion by 2030, growing at a CAGR of 7.70% from 2023 to 2030.

| 1st Generation | 2nd Generation | 3rd Generation | |

| Evolution | originally worked for fast fashion with trends and fast fashion, affordable prices, and quality | originally work for fast fashion with trends and fast fashion, affordable prices, and quality | With the Digitalisation market GAP filled it with more catchy trends, prices, and Quality. |

| Companies | H&M, Zara | ASOS, BOHO | Shein and Temu |

| Timeline | 2000 to continue | 2005 to continue | 2015 to continue |

With the evolution of decades, fast fashion also shifted with the help of digitalization and data-driven markets. H&M & Zara were the first players in the market with the concept of fast fashion. They worked on trends prices and fashion which gave the generation of the 2000s a new experience of fast fashion, their trending shifts and changing the outlet collections made the best experience for the customer. In 2008 Internet BOOM happened and with the help of the Internet few new players were introduced in the market eg: ASOS and BOHO. Digitalization shifted the market into a new concept that people can explore the products online customer experience something better than brick and mortar, the data-driven market helps the market to introduce some new players eg: Shein and Temu new players focused on data-driven and trend-wise marketing, they collect data from current customers, customer experience and customer behavior they worked on their toes to get the correct product.

Marketing Share Brand wise

First Generation: H&M and Zara market share

| 1st Generation | |

| Marker share | |

| Companies | H&M, Zara |

| Timeline | 2000 to continue |

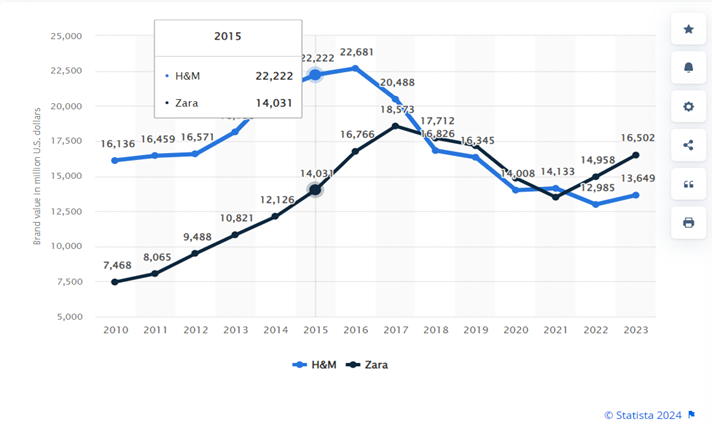

In 2023, the Zara brand was valued at approximately 16.5 billion U.S. dollars. In comparison, the value of the H&M brand was just under 13.65 billion U.S. dollars that year. This widened the gap between Zara and its fast-fashion

Second Generation: Boho and Asos market share

| 2nd Generation | ||||||||

| Brand value in millions | ||||||||

| Companies | ASOS, BOHO | |||||||

| Timeline | 2005 to continue | |||||||

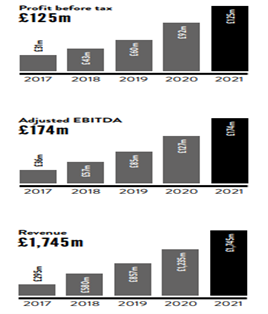

ASOS is one of the most successful online-only fashion retailers in the industry. Originally a UK-based company, ASOS had the highest number of users in the European Union as of August 2022. Globally, there are over 26 million active customers on asos.com, which the retailer defines as “having shopped in the last twelve months as of 31 August 2022.”

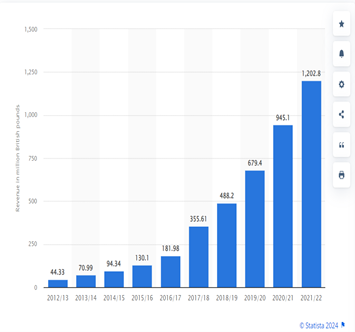

This statistic shows the revenue of the Boohoo.com Plc. group in the United Kingdom (UK) from 2012/13 to 2021/22. In the year ending February 28, 2022, the group accumulated revenue in the UK of approximately 1.2 billion British pounds.

Boohoo.com Plc. is an online fashion retail group that owns the brands Boohoo and Boohoo MAN in the UK. On 3 January 2017, the group also acquired a 66 percent interest in the fashion brand, PrettyLittleThing.com Limited, and on 28 February 2017, it acquired the intellectual property of the US brand, Nasty Gal. The group designs, sources, markets and sells clothing, shoes, accessories, and beauty products, targeting consumers aged between 16 and 30 years. The group has a strong presence in the UK, the US, Europe, and Australia.

3rd Generation : Shein and Temu

| 3rd Generation | ||

| Statistics | 1)Shein generated $22.7 billion in 2022, a 44% increase on the $15.7 billion it made in 2021 2) It has an estimated 88.8 million active shoppers, 17.3 million are based in the US 3) Shein was downloaded 200 million times in 2022, making it the most downloaded-shopping app of that year 4) It was recently valued at $68 billion ahead of a potential late 2023 IPO | 1)Shein generated $22.7 billion in 2022, a 44% increase on the $15.7 billion it made in 2021 2) It has an estimated 88.8 million active shoppers, 17.3 million are based in the US 3) Shein was downloaded 200 million times in 2022, making it the most downloaded shopping app of that year 4) It was recently valued at $68 billion ahead of a potential late 2023 IPO |

| Companies | Shein and Temu | |

| Timeline | 2015 to continue | |

Shein is, by some measures, the largest online-only fashion company, which may be a surprise to those who have never heard of the app. It is now the leader of a new generation of fast fashion that puts Zara and H&M to shame, producing thousands of new items to match the current trends every week.

Temu, which is owned by Chinese e-commerce giant Pinduoduo, launched in the US in 2022 and select European countries in 2023, offering a megastore of almost every conceivable item at a fraction of the cost.

Conclusion

The generation that defines fast fashion will be evolving and new forms of fashion that will be introduced by the 4th generation with technological improvements in AI, UI/UX, Virtual reality, and further technology will define fast fashion in other ways. The market is expanding day by day for fast fashion and people are consuming fashion.